As of September 2023, the majority of economists forecast a recession by Q2 of 2024, but economic conditions may already be eroding your clients’ ability to pay for veterinary care.

The Case for Recession

International Monetary Fund Report, July 2023

Since 2021, the IMF has worried that pandemic-related shutdowns would cause the world’s poorest economies to fall into financial crisis. That prediction proved accurate, but the subsequent impact on the overall global economy has been minimal. Indeed, as of late, the organization is more sanguine about overall global growth, but it acknowledges that risks to economic upset are still formidable:

- Global growth is projected to fall from an estimated 3.5 percent in 2022 to 3.0 percent in both 2023 and 2024.

- Core inflation will remain persistent in 2024.

- Overall inflation forecasts for 2024 have been revised upward.

- The balance of risks to global growth remains tilted to the downside.

- Ongoing Central Bank policy tightening may trigger unexpected financial sector turbulence.

- China’s real estate crisis could lead to negative cross-border spillovers.

Geo-political and Economic Unrest

Civil unrest has increased significantly since 2022, but as large as problems are Sahel, Nicaragua, Ecuador, Haiti, Venezuela, Argentina, et al., there are two other regions’ woes that loom larger still:

The Ukraine-Russia War

The Ukrainians and Russians remain deadlocked in conflict. As each side enlists the help of other countries to gain a leg up in the war, the risk of escalation increases . Also, both Russia and the Ukraine have expanded the field of battle into the Black Sea disrupting grain shipments and overall import and export activities in the area.

China

There are two developments in China that risk global financial upset:

- Increased militarization of the China Sea: China is engaged in heightened saber rattling. Experts agree that the country’s bellicose behavior towards Taiwan is worrisome. The country has also increased the militarization and weaponization of the China Sea upsetting more than 200 years of maritime standards (Laplatre, 2023).

- Real estate crisis: Two of China’s largest real estate companies, Country Garden and Evergrande, are at risk of defaulting or have defaulted respectively. Because of their size, there has already been spillover into China’s financial sector.

Stubborn Inflation

Despite some economic cooling in 2023 and two back-to-back breaks in rate hikes, Fed Chairman, Jerome Powell, remains hawkish in his pursuit to stop inflation. Said Powell in August 2023, “We will proceed carefully as we decide whether to tighten further or, instead, to hold the policy rate constant and await further data.”

The Case Against Recession

Inflation Reduction Act and Global Warming Policies

While higher interest rates are generally drying up access to cash, the White House’s Inflation Reduction Act has stimulated some taxpayer savings and manufacturing investment in certain areas, though it is important to note that even these modest claims are hotly debated.

The Green Movement and ´Friendshoring´ Will Spur Growth

Supply shortages (and inherent security risks therein) caused by the pandemic and the Ukraine war have encouraged countries to turn away from globalization towards ´friendshoring´, or looking to more local sources for goods and services. Some economists believe that investment in building out new supply hubs along with a strong interest in developing green energy infrastructure will buffer the negative impact of high interest rates.

Does it Matter?

Regardless if a recession is here or stalks our future, some consumers have already changed their purchasing habits because of higher prices. Here are a few information bytes to chew on:

- According to Brakke research, veterinary practice revenue was up in 2022 over 2021, but more importantly visits were down, new clients were down, and gains in revenue were due mostly to price increases, not the purchase of additional services. It’s important to note that in an interview on the Cone of Shame, VetSuccess’ lead data sales person, Sheri Gilmartin, said that the overall increase in revenue in 2022 was actually less than overall price increases in the same time period. That is to say that the growth in revenue, in the context of all of the price increases during the same time period, reflects a decrease, not increase, in real growth .

- Some veterinary corporations have cut staff in 2023:

- IVC Evidensia, holder of more than 2600 veterinary practices worldwide, is scheduled to lay off some Canadian employees.

- Pathway Vet Alliance will be shuttering the Emergency Veterinary Clinic of Rochester and laying off all employees.

- Overall annual veterinary inflation is at 10.3% between 21-23

- Total pet costs are up by 21.9% since 2021.

- Total veterinary costs are up by 27% in the last 24 months as of June 2023.

- As of September 2023, Year-over-year sales and visits are down by ≈ 3%.

What to Do

How long this downward pressure on sales and visits will exist, is not known. That’s probably more likely to be defined by the services you deliver, where you are located, your business model, your visibility, and so forth. If the recession of 2007 is any indicator, you can expect low-to-no-growth and some brow mopping as you worry your way through lean months, but no catastrophes provided you keep an eye on costs and cash flow.

Still, it would be prudent to make some proactive changes in the way you run your business, not only as a precaution against upcoming lean months, but as a way to streamline what you do, make your work more enjoyable, and even create a better client experience. Wouldn’t that be a very silver lining indeed in the dark clouds that are organizing above 2024? Here are some thoughts:

Improve Efficiency

Pandemic-related staff shortages and high volume didn’t break all veterinary hospitals; for some, the pressure served as inspiration! Veterinary hospitals made some dramatically innovative changes to the way they served patients.

Focus on What You Say, Not How Long You Say It

We have this notion in vet med that more client education equals better service. This is not true. The best service experience includes listening to the client´s needs, assessing the patient’s needs, telling the client what you think they should do, and then waiting to read the client´s thoughts or hearing what they think. If, at that moment, you believe more education is appropriate, go for it, but clients crave connection before information. Recommendations and any necessary explanations should be in the context of listening, understanding and specific client and patient needs.

Type Less

One of the most important objectives of every exam experience is to kindle a meaningful relationship with the pet owner. That means stop typing in the computer, stop looking in the computer, stop, stop, stop all of your interaction with the computer! The computer is not paying the cost of this $450 veterinary visit. If you are typing notes into the computer during the client exchange, you’re diluting your focus and undermining your ability to write cogently, type correctly, and pick up on the conversation where you left off. When dialoguing with clients, do just that. If the information you learned in the room is important enough, you’ll remember it after you’ve left the room. Once you are outside, you can complete your notes, but while you are in the room, your focus should be on the client, not the computer.

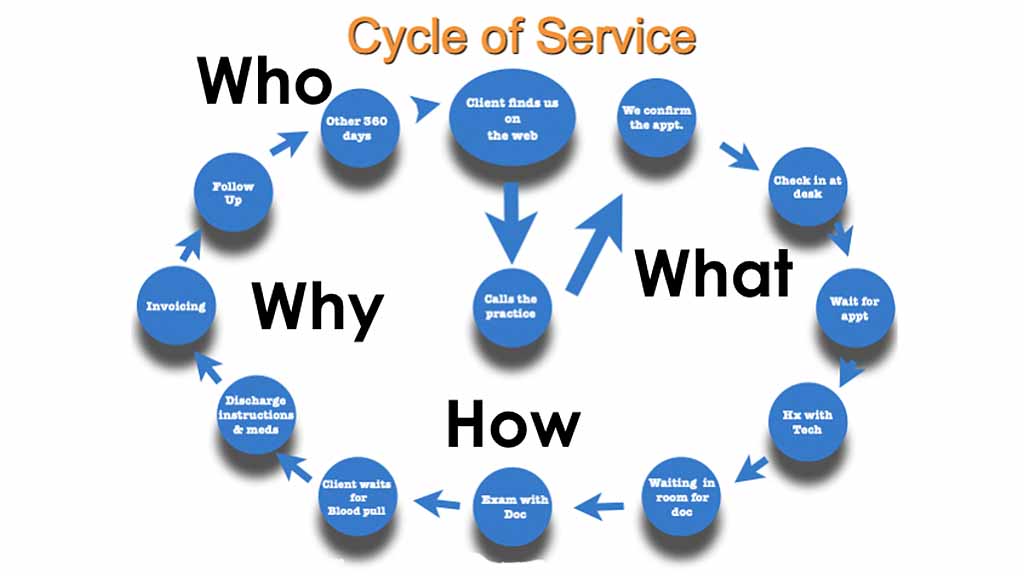

Walk Less

This is the cycle of service at a typical general practice. When looking for efficiency opportunities, ask yourself who each step of the cycle is serving, what each step is trying to accomplish and how, and then finish with a final question, why are we doing it the way we are? Is there a better way?

I have written extensively on the inefficiencies and lackluster service inherent in our usual approach to client care. You’ll probably come to the same conclusions if you spend some time observing how you serve clients or minimally, revisiting the goal of each step and whether or not the labor and time invested is worth it.

Talk about Talking About Money

Reviewing an estimate of services with a client who is in financial straits would be hard for anyone. It’s doubly uncomfortable for the inexperienced members of your team or those who are so young they still are not paying their own bills, let alone coaching pet owners 20 years their senior how to pay theirs.

Veterinary team members are expected to frequently discuss emotionally-loaded topics such as grief, pet care mistakes, and financial hardship, yet we provide them little more advice than, ´Use your common sense.´ We have to do better. Use the notes from the paper, Navigating Emotional Conversations, to get started on building education for your team.

Revisit Client Financing Options

With or without the downturn, you have cycled through enough employees that everyone would benefit from revisiting your hospital’s financial policy. Here is a list of some helpful third-party companies, as well as some new faces on the scene, that I have found helpful when managing veterinary costs, both for your clients and you!

SignaPay

Unlike the other solutions in this line up, SignaPay helps you cover the costs of veterinary medicine by reducing the amount of money you pay to take credit card companies. Depending on the size of your practice, you could be spending 12-to-100 thousand dollars a year in processing fees. That means that every time a bank gives miles or money back to a credit card consumer, you’re paying for it. Some businesses are pushing back and asking clients to pay their own fees and interestingly, it’s working! SignaPay provides your team free training and terminals so that you can take credit card payments without paying any processing fees.

Snout Wellness Plans

Snout wellness plans are remarkable in that they finance all of the wellness care for clients. Once the client is signed up for the 12-month plan, hospitals can deliver wellness care and receive payment for that care by Snout within 48 hours. In the meantime, Snout takes responsibility for collecting the monthly payments and the risk of default! Snout offers free 15-minute zoom conferences so that you and your management team can get a fast, but thorough understanding of what they do.

Vetbilling.com

Vetbilling is a family-owned, veterinary-payment, installment company that has enjoyed steady growth built solely on impeccable ethics, near-total customer satisfaction, innovation, and a support team that builds trusting relationships with its clients. Vetbilling´s business model is unique in that veterinary hospital clients are not charged any financing fees. Moreover, there are no limits on who can or cannot be approved. Practices are free to write payment plans on any terms they choose. It’s an excellent product for those hospitals that want the liberty of extending credit to clients who might not appear credit worthy on paper, but who have a trusting relationship with the business. Best of all, Vetbilling manages the collection of all payments so veterinary team members never have to assume the role of debt collector or bad guy. In addition to payment plans, they also offer pet health savings accounts and wellness plans. They are currently offering any referrals a 60-day free trial period.

CareCredit

Still an industry standby after all these years, CareCredit has the benefit of longevity in the marketplace, a product that can be used by the pet parent for both animal and human care, and assistance in helping new clients find veterinarians in their area that accept the CareCredit card.

Enable The Software to Automatically Apply Markup

If you haven’t taken the time to set up your software so that prices are automatically adjusted in response to higher inventory costs, do so now. Use this time to revisit the way your inventory is ordered, received, and tracked to make sure that your system is decreasing the cost and waste of inventory management.

Increase Prices

The dollar has had a 19% decrease in value (CPI Inflation Calculator, 2023) since 2020, so earnings no longer have the same buying power they once had. A price hike may be your only option to catch up to what was a brutal two years of inflation. Remember consumers on fixed incomes will feel most squeezed by a recession and you don’t want your price increases to suggest that you are insensitive to your clients’ financial concerns. Use this link for more information on how to raise prices at a veterinary hospital and to use a free pricing calculator .

Reduce Inventory Redundancy

Don’t stock a ‘pharmacy’ of medication options, but pick one or two that all of your team members can get behind. When clients need another option, direct them to your online store.

Stay Grounded

A potential drop in business is frightening for any business owner, but try to stay level-headed. Having been a manager during the Great Recession, I can offer a few pieces of information that will help you to stay cool-headed.

Remember, the Great Recession Wasn´t that Great

I managed a 13-doctor practice during the Great Recession. Though the practice was located in an affluent part of New Jersey, business fell off a cliff the day following the Lehman crash and remained slow through 2010. However, while we struggled with growth, we remained profitable as did most veterinary practices in North America. Barring any real meltdown (war, another financial institution implosion, etc.), I think the same will be true for veterinary practices living through down times in the months ahead.

People Still LOVE Pets

Each year, pets are more deeply integrated into the homes and lives of Americans. For many, they are family friends not just furry ones. While pet owners may dial back spending on lattes, or gym memberships, they won’t leave obvious, pet medical issues go unattended for too long. Despite the aforementioned 21.9% rise in pet costs (Gibbons, 2023) over that past 24 months, sales trends are still positive.

Conclusion

You wouldn’t be where you are today if you didn’t have resilience, perseverance, intelligence and optimism. It got you this far and it will likely take you through the rest of the problems you will experience in life including any future economic downturns. Try not to allow worry to pollute your enjoyment of what is about to unfold for you and your team. Provided you stick to your mission to care for pets and people, to do good work, and to do it together, it is likely that nothing will get in your way of decent profit, personal growth, and fun.