In December 2021, the Consumer Price Index, a benchmark for inflation, rose to 7%, a height not seen such 1982. The steady rise of consumer prices has both the Federal Reserve and financial analysts concerned that inflation will remain through the 1st quarter of 2022. Here are some considerations for managing your veterinary business during this current inflationary cycle…and what may come after that.

What is Inflation?

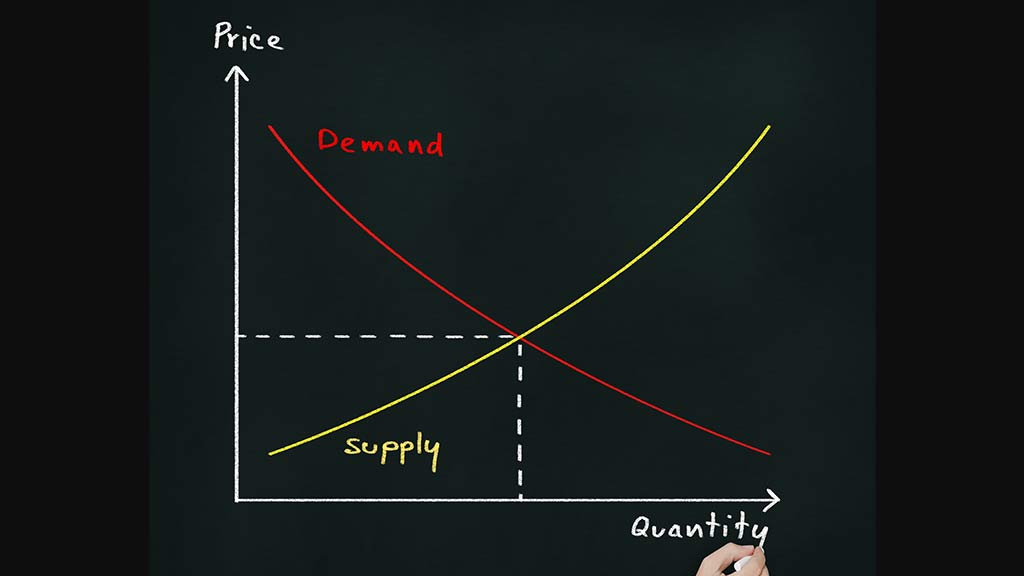

Inflation is the decreased purchasing power of currency. It can be triggered by an overheated economy where consumers’ willingness to buy services and goods outpaces supply. Other reasons can include decreased valuation of currency in foreign markets and changes to the way the federal government manages its debt.

Nearly all economists agree that some inflation is good; a 2-3% annual rise is usually a sign of healthy times. But as inflation heats up and erodes at buying power, consumers stock up on supplies they fear will rise in price. This exacerbates the shortages and worsens the crisis.

Historically, the central bank of the U.S., the Federal Reserve, has acted on inflation by increasing the federal funds rate which serves as the foundation for lending rates throughout the U.S. If the Fed get it right, the economy responds and things return to a sense of normalcy; however if the actions of the Fed alarm the market, additional economic complications arise. That’s why the Fed is always so cautious with raising rates or even talking about raising rates; they never know if their actions will set off a stampede of nervous investors.

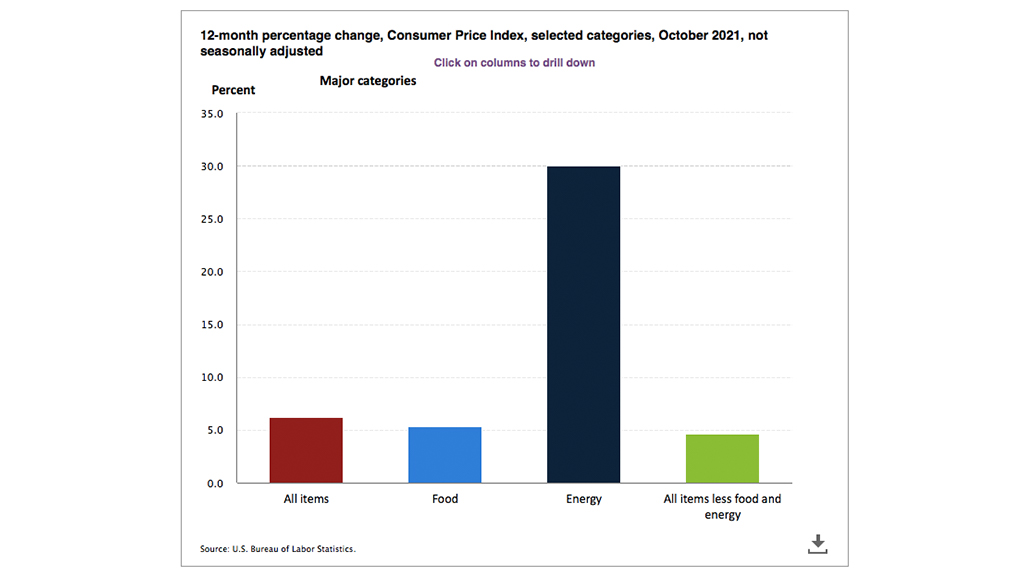

Mostly fueled by a big jump in energy prices, the Consumer Price Index for the 12 month period ending October 2021 was up 6.2% over the previous 12 month period. December numbers showed a jump of 7%. Such a large increase has not been seen since the Great Recession, nor been exceeded since the early 80’s To drill down into each of the sectors shown, go to https://www.bls.gov/charts/consumer-price-index/consumer-price-index-by-category.htm and click on the respective link. Credit the U.S. Bureau of Labor Statistics.

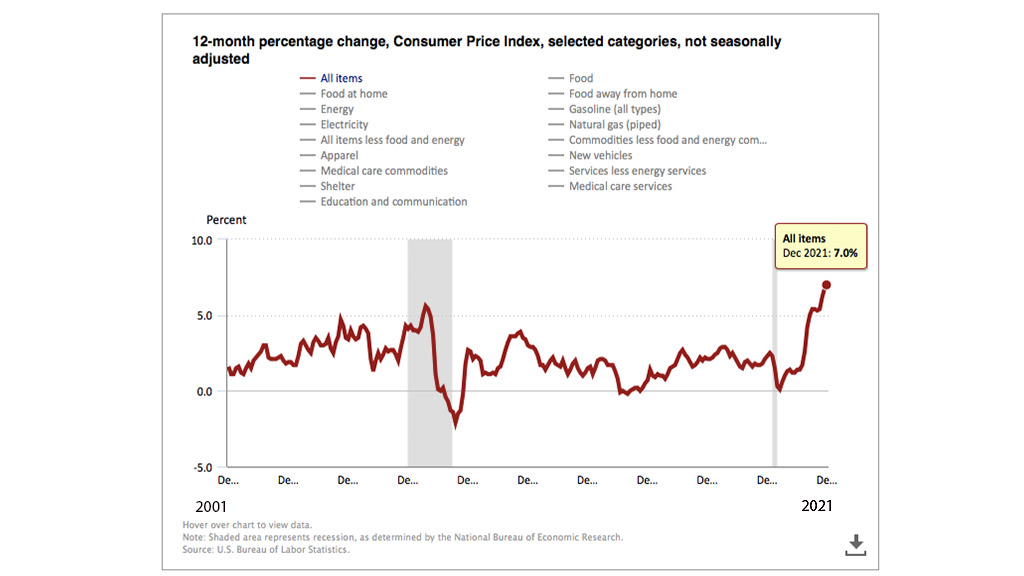

Graph showing the 12 month percent change in the Consumer Price Index since 2001. The Consumer Price Index is a look at the total cost of a hypothetical ‘shopping basket’ of the most commonly purchased goods and services in the U.S. Credit the U.S. Bureau of Labor Statistics.

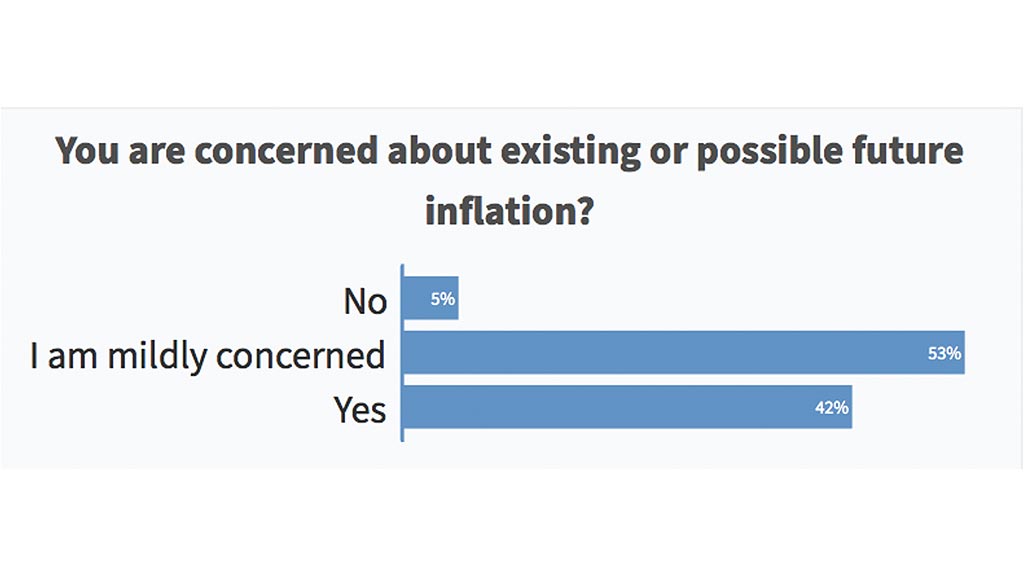

Throughout the 2021 FETCH veterinary conference year, veterinary leaders were asked whether inflation was a business concern. For more information on attending one of these interactive lectures, visit https://www.dvm360.com/conference and use discount code Faculty10 for 10% off registration fee.

How Inflation Impacts The Small Veterinary Business

Some Of Your Clients May Benefit Financially From Inflation

Though inflation sounds scary, it’s not bad for all consumers. Remember that in an inflationary cycle, currency loses value. That means that the dollars in your wallet aren’t worth as much, but it also means that the debt that you owe has equally diminished value. So if you are a home owner, it’s likely that the value of your home has increased, but when measured against the current value of currency, the mortgage you owe on it is worth less. Wages and the value of possessions also usually go up in an inflationary economy, so If you are a business owner with middle and high income clients, it may be that your customers will see a positive change in their net worth and feel more comfortable spending money for your services.

Increased Costs and Demand For Higher Wages

On the flip side, your team members fielding multiple offers for employment and feeling the crunch of higher prices may demand higher wages. Your utility and supply costs have also likely sharply increased. If your clientele is on a fixed income, they will be especially hard hit by rising prices and will likely balk at any elective medical recommendations.

Small Businesses Versus Large Businesses

On the whole, most economists believe that small businesses feel the pains of an inflationary economy more than large businesses. Small businesses just don’t have the same power to hedge against rising costs by stockpiling inventory or to absorb higher wage costs.

No-Cost Lunch-And-Learns For Your Group

Bash presented at the SPVS-VMG 2020 Conference in the UK and the feedback was amazing. Everyone rated him 5 out of 5 and had these kinds of comments:

- Enthusiastic and encouraging speaker.

- Great presentation.

- Energetic and motivational and lots of common sense.

- LOVED LOVED LOVED!! Bash smashed this and I would come again just to listen to him! His vision of a veterinary practice is exactly how I see it

Open any of the topics below or click through to the speaker page. Often presentations are fully supported by sponsorship. Email Bash for more information.

Design Thinking for Employee Engagement and Client Satisfaction

Design Thinking is a problem solving technique used by some of the biggest businesses in the world including Toyota, Samsung and Apple Computer. It pushes employees to see their business's internal issues their the eyes of clients and consequently to gain new perspective. Most of the time, the experience is so impactful that the problems themselves end up being redefined. This is a fun, engaging way for you and your employees to solve chronic issues like staff shortages, client wait time, and overbooking in a way that you never dreamed possible. This workshop was chosen by to be part of the prestigious 2022 VMX lineup.

Effective Client Communication (RACE approved)

Taped phone calls to veterinary practices leave audience members slack jawed and laughing before Halow pulls audience members into a discussion of exactly what we are trying to say to clients and how to say it. This lecture is a number 1 hit with audiences, mostly because it calls out some behaviors that everyone else is afraid to point out, but not to worry, no one will leave angry. Bash will handle things with his usual good humor and spirit of open discussion. “This program has been approved for 1.5 hours of continuing education credit in jurisdictions which recognize RACE approval. “

Best Practices In America (RACE approved)

This is a fun, informative, and stimulating lecture. Team members work in small groups before engaging with Bash in a dialogue about motivation and what's energizing about our jobs. All of this as a lead in to a lecture about the hospitals in America where fulfillment, happiness, and great service are an every day occurrence. “This program has been approved for 1.5 hours of continuing education credit in jurisdictions which recognize RACE approval. “

Compassion Fatigue: A Way Forward

This class invites audience members to take a standardized self-test for job satisfaction and workplace fatigue, after which results are shared anonymously through a live poll. Bash concludes the lecture with the facts on compassion fatigue and what all practices can do to guard against it. The results of the test are often a source of many wide eyes in the audience. This lecture succeeds on motivating leaders to take workplace satisfaction seriously.

Will This Inflationary Cycle Last?

A heavily relied-upon prognosticator for inflation is the bond market. Because currency loses value at a faster pace during inflation, investors worry that conservative bond yields aren’t worth the cost. Hence bond traders/issuers do two things to entice investors: they lower the price of bonds and raise the amount of promised yield.

That’s not been the case as of late. The cost of a 10-year Treasury Bond, considered the benchmark for all bond prices, increased while yields decreased during the second quarter 2021. This flies in the fact of logic, especially when you contrast bond yields with inflation and adjust for real rates of return which are currently in the negative. That is to say that yields are so low and inflation is so high that by the time that a Treasury bond pays off, the investment has cost the investor, not earned a rate of return.

So what’s going on? Well, it’s complicated; but in basic terms, the continued buying can be lumped into three categories:

Foreign countries are stockpiling T-notes: Let’s say that you’re a country on shaky economic ground and your currency is in danger of devaluation. Taking a considerable portion of your cash and investing in T-notes grounds your nation’s economy in trusted value. It’s the equivalent of stockpiling gold, but in this case your ‘gold’ is U.S debt.

Pension funds buy T-Notes to cover higher future costs: Big pension funds use Treasury notes as a way to ensure their ability to meet future cash flow and liability demands. As the rate of return of Treasuries decrease, the future level of the organization’s liabilities increase forcing the organizations to buy more Treasuries to cover expenses.

Investors bet on price swings: Demand for the T-note, even with a real return in the negative, is being driven by some investors who are betting that future T-note prices will vary enough that they can benefit from the spread. These investors are applying a trading strategy called hedging where an investor buys an investment product at one price, but with the believe that the price will be predictably higher or lower in the future.

$1000.00

$1000.00 referral fee for veterinarian applicants. Sign on bonuses also available. More.

Managing Your Veterinary Practice In An Inflationary Economy

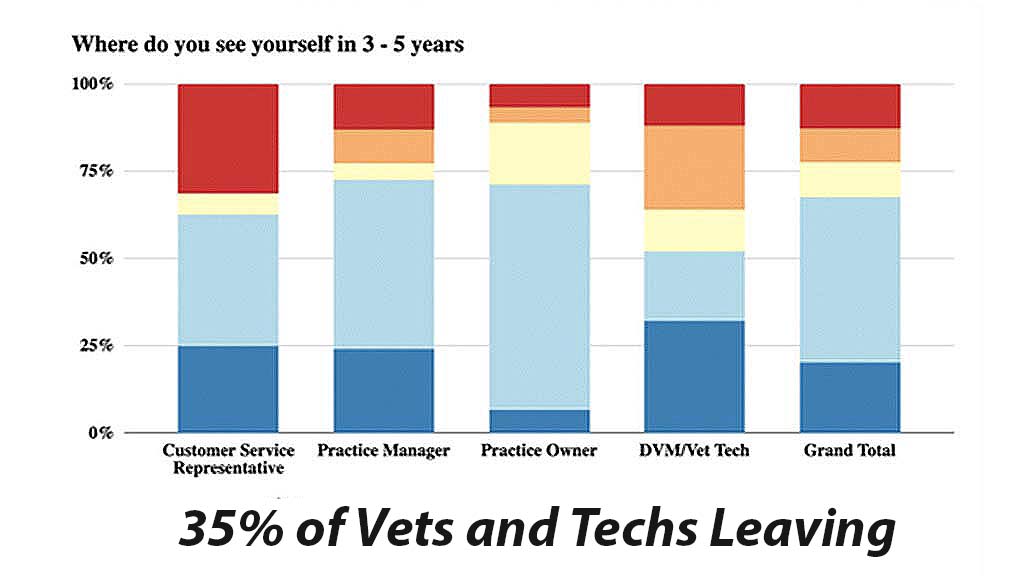

An inflationary economy is likely to add to your existing post-pandemic woes. Labor shortages and wages will continue to rise. Inventory prices and shortages will also increase and appointment books will remain packed as pet owners respond to a sense of increased wealth and low interest rates.

The good news is, preparing for an inflationary economy is usually prudent business management independent of what’s happening with inflation. Implementing these safety precautions will both guard against inflation and make your practice stronger overall.

Enable The Software to Automatically Apply Markup

If you haven’t taken the time to set up your software so that prices are automatically adjusted in response to higher inventory costs, do so now. Use this time to revisit the way your inventory is ordered, received, and tracked to make sure that your system is decreasing the cost and waste of inventory management. For a primer in veterinary inventory management use this link https://www.bashhalow.com/how-do-you-manage-inventory-at-a-veterinary-practice/ .

Increase Prices

Even typing the heading makes me anxious since I think there are so many ways to incorrectly raise prices, so please be thoughtful about how you do it. Remember consumers on fixed incomes and those about to run out of unemployment benefits will feel most squeezed by higher prices. You don’t want your price increases to suggest that you are insensitive to your clients’ financial concerns. Use this link for more information on how to raise prices at a veterinary hospital and to use a free pricing calculator.

Reduce Inventory Redundancy

Don’t stock a ‘pharmacy’ of medication options, but pick one or two that all of your team members can get behind. When clients need another option, direct them to your online store.

Encourage Preventative Care

For the first time in years, clients may have more discretionary income. Take an additional moment to scan through your charts and make sure that patients are up-to-date on dental prophylaxis, wellness screens, and year-round parasite prevention. You’re likely to get a higher client compliance rate with these recommendations and the added revenue will shore up your ability to respond to higher inventory and wage costs.

Increase Efficiency

Most practices have reported record sales in 2020 and the first quarter of 2021, but at what cost? Teams are understaffed and overstretched. Working harder and faster is no longer an option. You have to leverage technology to increase efficiency.

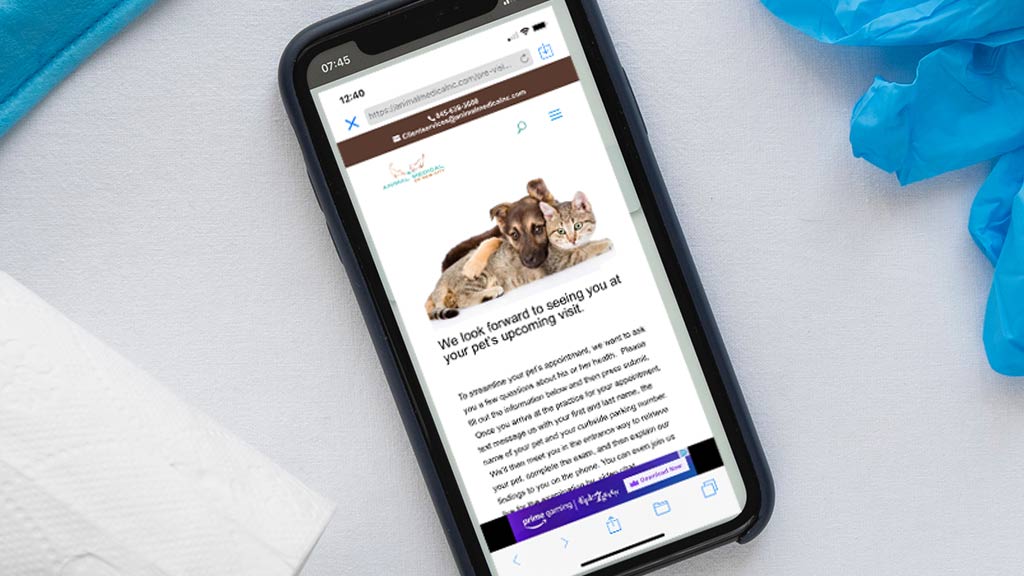

Explore how telemedicine can take some of the pressure off your appointment book and how the many apps on the market these days can bring automation to client service and shoulder some of the work of your CSRs. Don’t be afraid to completely overhaul the client cycle of service to minimize redundant communication and inefficiencies.

Evaluate Pay Rates

In conjunction with the above, redefine or even reinvent the roles of your practice team. Look at financial ratios like gross revenue/payroll hour or payroll/gross revenue to see how you stack up to the competition. For the latest benchmarks in this new era, attend a DVM360 Fetch Veterinary Conference.

Outsource Some Responsibilities

Chronos is a veterinarian-owned company that hires and trains dedicated remote receptionists, nurses and managers. They provide custom solutions for each practice including front desk support and relief surgery services.

Increase Access To Financial Payment Option

Contact reps from Vetbilling.com, CareCredit, Scratchpay, Vet2Pet and VitusVet to learn how consumers can spread payments out over time with little to no financial risk to your practice.

How Long Will It Last?

it’s important to note that the Federal Reserve is basing its economic policy on past inflationary events, but this new one that we are experiencing has some unique qualities that may ultimately thwart the most experienced economic forecasters. Here are some considerations when contemplating the long-term inflationary outlook:

Supply issues are transitory: Currently the world is experiencing supply interruptions due to the pandemic, but don’t forget that there are thousands of cargo containers sitting stationary at ports all over the world just waiting for someone to come to work to open them. Our supply issue is just as much driven by access as it is the existence of actual supplies. In other words, it’s not that we don’t have it; it’s that we can’t get our hands on it. A big part of the supply issue will go away as soon as we can get employees back to work on a regular basis.

Omicron is dampening the economy: The current Omicron wave is dampening economic activity and decreasing the consumption of goods and services. This puts the brakes on inflation because it eases the need for supplies.

Federal reserve will likely raise interest rates: Concerned that its quantitative easing has infused the economy with too much cash, the Fed has hinted strongly that it will raise interest rates. This will restrict access to cash and put downward pressure on inflation.

Wall Street is growing increasingly anxious: Recent market volatility suggests that investors are anticipating a downturn in the market. As they pull capital out of riskier investments, they reduce the overall net worth of investments worldwide and discourage the production of some goods. This, along with other factors, could produce a stagflation economy where prices remain high, but the economy grows increasingly sluggish.

Stagflation

Stagflation economies (high prices + sluggish economic output) are particularly hard to navigate and small businesses should tread cautiously with aggressive price hikes over the next couple of months. Should things appreciably slow down, you don’t want to be in a position where you have both alienated existing clients and turned off new ones because you’ve pushed prices too high too fast. Read how to Raise Veterinary Prices for more information.

Phil Zeltzman, DVM, DACVS, CVJ, Fear Free Certified, is a board-certified veterinary surgeon and serial entrepreneur whose traveling surgery practice takes him all over PA & NJ. He is cofounder of Veterinary Financial Summit, an online community and conference dedicated to personal and practice finance (www.VetFinancialSummit.com).

Growing and Caring For Personal Wealth During Inflation

Ask An Expert: Dr. Phil Zeltzman

As cofounder of the Veterinary Financial Summit, Phil Zeltzman, DVM, DACVS, CVJ wants to help all veterinary professionals grow their wealth. Here are his tips for how to manage your money in an inflationary economy.

Take advantage of low interest rates

As inflation creeps up, interest rates will follow. Here are ways to take advantage of super low interest rates while they last.

- Refinance high-interest loans like home mortgage, practice mortgage, or equipment contracts.

- Don’t prepay low interest, student loans. Instead, use the money to invest or save for your retirement.

- Borrow “cheap” money to renovate your practice or upgrade equipment.

Offer competitive wages

Nationwide wages have seriously spiked. A North Carolina gas station is offering employees $15-16/hour to pump gas plus a $50-100/week bonus for staying on the job. At McDonald’s, executives approved a new pay rate of $11-$17 per hour for “sandwich artists” plus a $50 bonus just for showing up for an interview!

Demand for higher wages doesn’t have to be bad for you if you are an employer. If you find a way to engage your entire team in the process of cutting expenses and growing revenue, and then using some of that added profit to increase wages, you show respect and concern for a critical component of your business: your staff. You’ll retain team members for a longer period of time and you’ll find they put more discretionary effort into their work. They’ll start to think and act like owners.

Additional Reading

Let’s Get Started